Leeds Index: Colorado business confidence falls slightly going into fourth quarter

The confidence of Colorado business leaders has slightly declined going into the fourth quarter as uncertainty facing a potential government shutdown and the federal deficit increased, according to the most recent Leeds Business Confidence Index, or LBCI, released Tuesday by the University of Colorado Boulder’s Leeds School of Business.

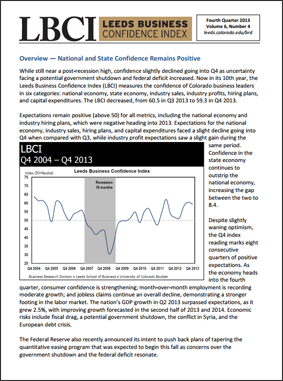

The fourth quarter LBCI posted a reading of 59.3, which is a decrease from 60.5 last quarter but still near a post-recession high. Expectations measured positive -- at 50 or higher -- for all of the metrics measured by the index, which include the national economy, state economy, industry sales, industry profits, capital expenditures and hiring plans. These across-the-board positive standings come after the national economy and industry hiring plans categories were in negative territory just three quarters ago.

“Business leaders remained optimistic overall, despite confidence being tested by uncertainty coming out of Washington,” said economist Richard Wobbekind, executive director of the Business Research Division. “Coupling business confidence with other economic metrics, Colorado looks to be on a stable growth trajectory.”

The Leeds School’s Business Research Division conducts the LBCI, which now is in its 10th year.

Confidence in the national economy was the most significant finding revealed in this quarter’s numbers, especially given underlying federal budget uncertainty, according to Wobbekind. Confidence in the national economy fell 2.6 points to 55.5 in the fourth quarter, down from 58.1 last quarter.

Confidence in the state economy, which decreased to 63.9 in the fourth quarter from 64.6 last quarter, outpaces that of the national economy. The outpacing of confidence in Colorado’s economy compared with the national economy is a 34-quarter trend, based on LBCI results.

Business leaders’ sales expectations for the fourth quarter came in at 62, down from 63.7 for the third quarter, while the profits metric increased slightly.

The capital expenditures index fell to 57.4 for the fourth quarter, down from 59.3 for the third quarter. The hiring plans index decreased to 57.8, down from 58.9 last quarter.

While Colorado employment figures vary greatly by industry, labor markets in most of the state’s metropolitan areas saw growth in August compared with a year earlier. The three areas showing the highest growth are the Denver-Aurora-Broomfield Metropolitan Statistical Area (MSA), the Greeley MSA and the Boulder MSA.

Statewide, the biggest employment gains in August compared with the same month last year were in the professional and business services sector with the addition of 16,400 jobs. The leisure and hospitality sector added 11,800 jobs and the education and health services sector gained 6,600 jobs.

More information about the LBCI, including the fourth-quarter report for 2013, is available at http://leeds.colorado.edu/brd#leedsbusinessconfidenceindex. For more information about the Business Research Division visit http://leeds.colorado.edu/brd#overview.